Overview

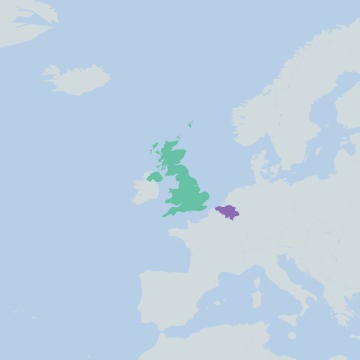

Euroclear, operator of the worlds premier settlement system for domestic and international securities transactions, and owners of CRESTCo, acquired EMXCo, the UK’s leading provider of mutual fund order routing and the de-facto standard for electronic order messaging of mutual funds.

The major shareholders of EMXCo prior to the disposal were Fidelity International, Hargreaves Lansdown, Invesco Perpetual, M&G, Skandia and Threadneedle.

Significance

The acquisition will lead to the development of an automated and standardised order-messaging and settlement solution for UK fund transactions. This will deliver significant reductions in manual overheads, including settlement and asset servicing, cost savings of up to 50%.

Longer term, EMXCo will contribute to the Euroclear group’s aim of providing the most efficient single platform for the order routing, settlement and asset servicing of fund transactions across multiple markets. Combining the highly efficient fund order-routing capabilities of EMXCo with the realtime settlement capacity of CREST will result in the introduction of a centralised fundprocess for the UK to deliver:

– straight-through processing for fund issuers and intermediaries through increased processing automation and standardisation of market practices;

– lower tariffs as a result of economies of scale and technological innovation;

– quicker cash payments;

– reduced operational risks; and

– greater appeal for retail and institutional investors to invest in funds.

Our Role

Advised Euroclear on the acquisition.