Overview

Neonet, an independent agency equity broker and execution specialist headquartered in Stockholm (Sweden), announced its sale to KCG, a US based group providing market-making and global execution services. Financial terms of the transaction were not disclosed.

Significance

The acquisition of Neonet allows KCG to strengthen its reach in continental Europe and will enable both KCG’s and Neonet’s clients to access a more complete range of international execution services and capabilities. Neonet’s sophisticated technology, experienced trading desks, and deep team of execution specialists are highly complementary to KCGs existing execution services and will help accelerate the growth of its agency client business.

Neonet is an equity execution service provider that offers independent, flexible and transparent execution services. Founded in 1996, Neonet serves clients in over 20 countries, and all its trades are executed on regulated markets.

KCG is a leading and US-listed independent securities firm, offering investors a range of services designed to address trading needs across asset classes and product types. The firm combines advanced technology with specialized client service across market making, agency execution and venues and also engages in principal trading via exchange-based market making. KCG has multiple access points to trade global equities, fixed income, options, currencies and commodities via voice or automated execution.

Our Role

NovitasFTCL was sole adviser to all shareholders of Neonet including Hay Tor Capital LLP, KAS Bank N.V., and Nordic Capital / Cidron Delphi Intressenter AB ending up in the acquisition of 100% of the firm by KCG.

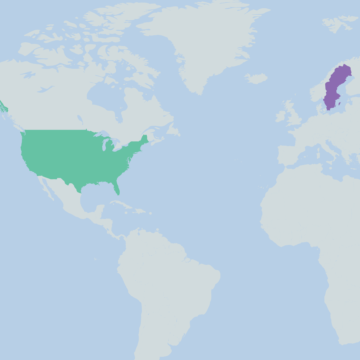

Transaction Map

Counterparty

Client